Updated in April 2023

Stopping Wage Garnishment After It Starts

Overview

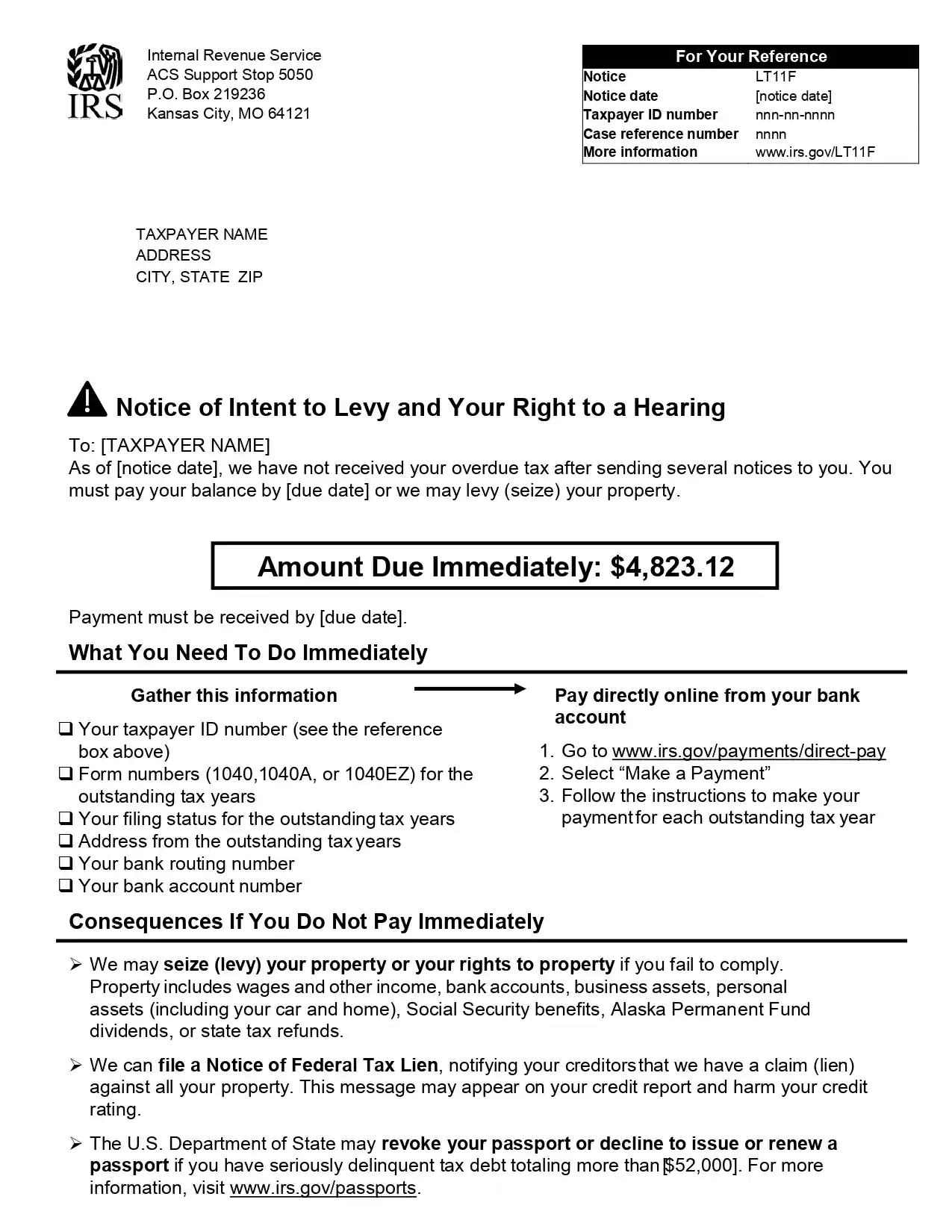

If you owe back taxes, the IRS may decide to garnish your wages to begin collecting your debt. However, if garnishment is causing financial strain, you may be able to stop the IRS from seizing your wages by requesting a Garnishment Release Order. Here’s how we helped this full-time professional stop the IRS from garnishing her paycheck.

Situation

Deborah came to us after learning that the IRS had begun seizing 30% of her wages to collect on back taxes. In addition to missing the previous year’s tax return, she owed $28,000 in back taxes, which caused her account to go into collections. As a result of the wage garnishment, Deborah was now losing close to $2,250 every month.

Solution

After preparing and filing her missing tax return, we discovered Deborah owed an additional $10,000, putting her total open balance at $38,000. However, because of her monthly income and home equity, we were able to help her set up a Streamlined Installment Agreement to replace and stop the wage garnishment.

Result

Due to the urgency of the situation, our team directly contacted the IRS Collections Department on Deborah’s behalf to set up a direct debit payment plan and request the garnishment be lifted. Once the agreement was secured, we had the IRS fax a Garnishment Release Order directly to Deborah’s employer, stopping the garnishment immediately. With the wage levies removed and her paycheck protected, she was able to save $1,700 per month.

Account Diagnosis

- Missing tax returns for 2021-2022

- Open balance of $28,000 from 2017-2019

- Total balance of $38,000 after unfiled returns processed

Program Evaluation

- Based on the Deborah’s monthly income and equity, she was eligible for a Streamlined Installment Agreement to replace the wage garnishment

Submission & Monitoring

- In just 1 week, we were able to file her missing returns, secure a payment plan, and obtain a Wage Garnishment Release from the IRS