If you owe less than $100,000 in tax debt, you might be shocked at how easy it is to resolve your tax account on your own.

Bobby was a great resource and helpful to understand the process. I had tax concerns that I didn't know how to navigate or what direction to go. He was able to research and help take stress off my shoulders. Definitely take the time to talk with Arch Tax about any questions you may have.

If you owe less than $100,000 in tax debt, you might be shocked at how easy it is to resolve your tax account on your own.

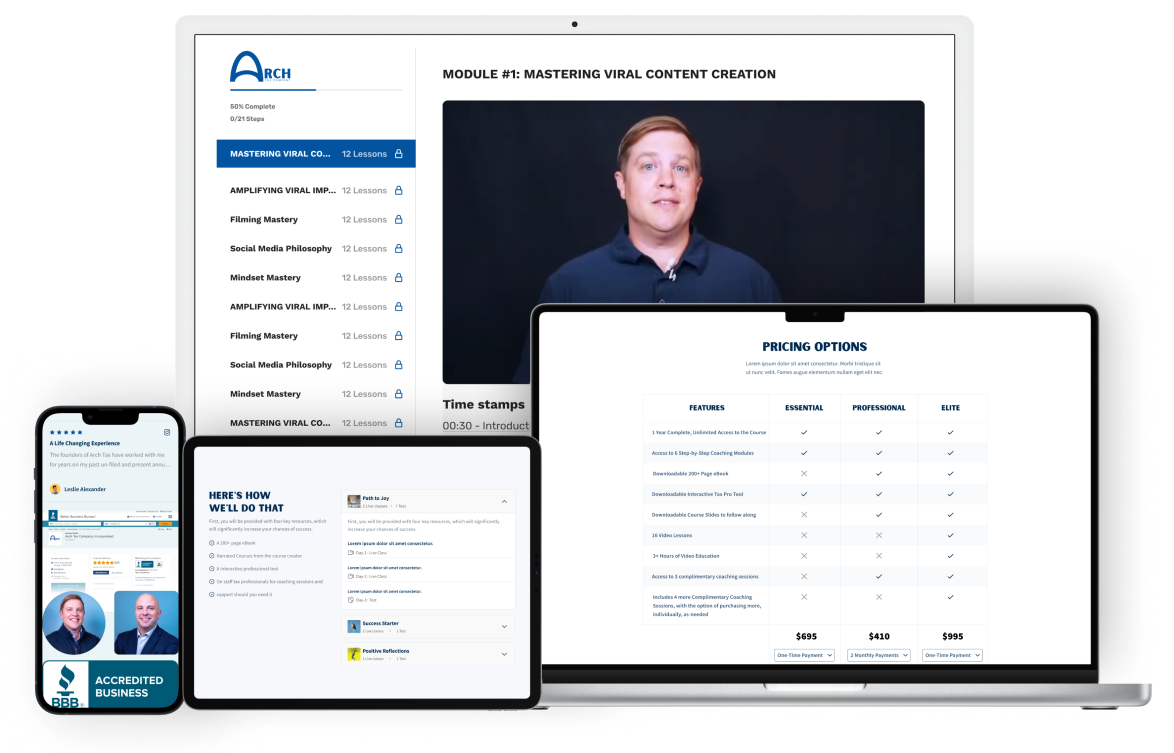

This DIY Tax Resolution course provides a step-by-step roadmap that helps you

Here’s how our DIY Tax Resolution course is helping everyday.

We’ve included built-in support for the course you can use to get help directly from our team of licensed experts.

Follow the same steps we’ve used to help thousands of people take the fear out of dealing with the IRS and resolve their tax debt for good.

This course gives you access to tax advice from professional experts without having to pay thousands in professional fees.

200-Page eBook

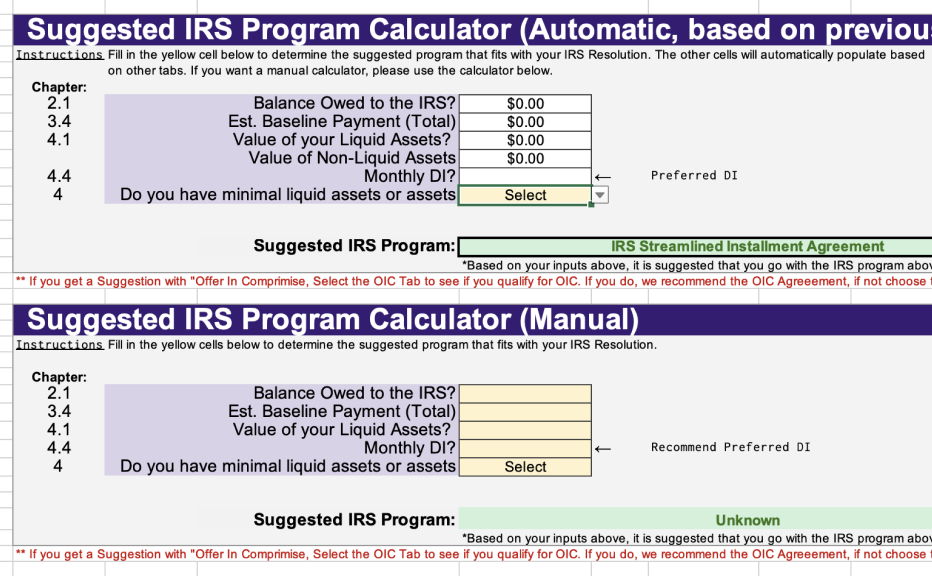

Interactive Professional-Grade Tool

Access the same tool our in-house tax experts use to help clients tax the complexity out of tax resolution. We provide a demo video that shows you how this easy-to-use tool makes resolving your tax debt simple and straightforward.

6 Coaching Modules

Get help throughout the tax resolution process with narrated courses and slides to visually show you what to do at each step.

Interactive Professional-Grade Tool

If you have any questions in the process, this course comes with access to our team that allow you to get help directly from our tax professional consultancy if needed.

Professional Tax Representation

If you decide at any point in the course that you’d like a tax expert to help you resolve your case, you can schedule a consultation with our team to get professional representation before the IRS at a discount.

06/06/2023

01/05/2023

“Chad helped with my tax issues, he read over the overwhelming about of papers and letters. He explained what everything meant and took the time to explain what my options were. I would recommend Chad to anyone that feels so overwhelmed and intimidated by Tax debt.”

10/12/2023

The founders of Arch Tax have worked with me for years on my past un-filed and present annual tax returns and I can’t say thank you enough for both their diligence and high levels of customer service. They make the process easy. As a self employed consultant, this is a complex endeavor for me and a process I don’t think I could navigate without them! Thank you for being the real deal in a world of AI bots and for delivering above and beyond. I can honestly say their service changed my life for the better. Can’t give much higher praise than that.

05/09/2023

Welcome to Do-It-Yourself Tax Resolution!

Module 1 focuses on the information gathering stage of your case. Learn how to gather invaluable information about your IRS account before speaking with a collections representative.

You will learn to accurately interpret and organize tax transcripts, ensuring you can efficiently extract key financial information. We will cover the different types of transcripts, how to identify crucial data points, and techniques for categorizing and storing these documents for easy reference.

Did you know that IRS balances expire? This is huge! Learn how to calculate your collection statute expiration dates and receive tips and tricks on how to handle your CSED.

Learn how to calculate your IRS ability to pay. This Module is crucial for learning to evaluate your own personal financial situation. Once mastered, you will know which IRS resolution to pursue!

Once you have made it through Module 4 the Ability to Pay Analysis, Module 5 provides a Quick Guide for which resolution you may qualify for.

You made it! Congratulations

Hi I’m Chad. I’m the creator of this course and have been a licensed attorney since 2008.

I’ve spent the last 15 years representing clients before the IRS learning about the inner workings of the IRS.

After working with several large tax companies, I became frustrated with the industry and wanted to offer help to those who couldn’t afford to hire a tax professional.

That’s why I’ve created this course – to give others the tools they need to resolve their tax issues on their own while saving thousands of dollars in professional fees along the way.

This course is contains all the tax resolution techniques and strategies I’ve learned over the past 15 years for resolving tax issues on your own.

In just 8 hours, you’ll pick up the skills and knowledge to:

It only takes 8 hours to learn how to resolve your IRS case. Follow the same steps that have helped 1,000s of people gain peace of mind.

This course is for anyone looking to resolve their tax issues on their own. If you owe less than $100,000 and earn less than $150,000, this course is the perfect course to help you find the right resolution for your situation.

Unlike other DIY services, this course will teach you how to think like the IRS and how to prepare yourself for the questions they are going to ask when you ultimately start working with them. You need to be confident and empowered with information to have a fair call with the IRS. If you don’t, the call can be intimidating and frustrating because you are not prepared, and the IRS has all the leverage when you are speaking with them.

We believe if you spend 20 minutes a day for 2-3 weeks that you will master this course and will develop the confidence and ability required to negotiate a successful resolution submission to the IRS.

However, we recognize that you may get into this course and realize that you do not have the time or desire to see it through. If that happens, just know that we are here to support you. If you need a helping hand or a safety net, we’ve got your back. An Arch Tax professional is standing by if you decide you would be better served handing your case to a tax professional. We will step in, for a discounted fee, to make sure that your case is successfully resolved.

If you complete this course and still are not able to determine the appropriate tax resolution for your IRS case, let us know and we will issue you a full refund.

Hiring a licensed tax expert to help you resolve your problem can be effective but often costs thousands of dollars. In our experience, many people don’t need to hire a professional to work with the IRS and can achieve a tax settlement on their own at a fraction of what most tax companies charge.

This course is designed to help you avoid overpaying for tax relief and relying on others to fix your tax issues for you. It arms you with the same knowledge and tools we use to help our clients, so you can quickly end your tax worries under the guidance of an expert at a cost that fits your budget.

While we’ve designed this course to be simple and straightforward, to our knowledge, the information you’ll discover inside is not commonly known or easily accessible online. In addition, you won’t find other DIY programs that provide 1-on-1 coaching with professional tax experts.

We created this course to save you the time and money it would take to navigate the tax code on your own and figure out which steps you need to take to achieve the right tax resolution for you.

Our comprehensive DIY Program provides you with only the most essential tools that you need to resolve your IRS tax issues on your own, including

I am confident that if you take our course, you will walk away with all the tools and knowledge that you need to resolve your tax issue on your own.

That said, if you don’t get a tax resolution after completing the course, contact us and we’ll issue you a full refund right away.

© 2024 Arch Tax Co | All Rights Reserved.