Updated in April 2023

How to Arrange a Streamlined Installment Agreement

Overview

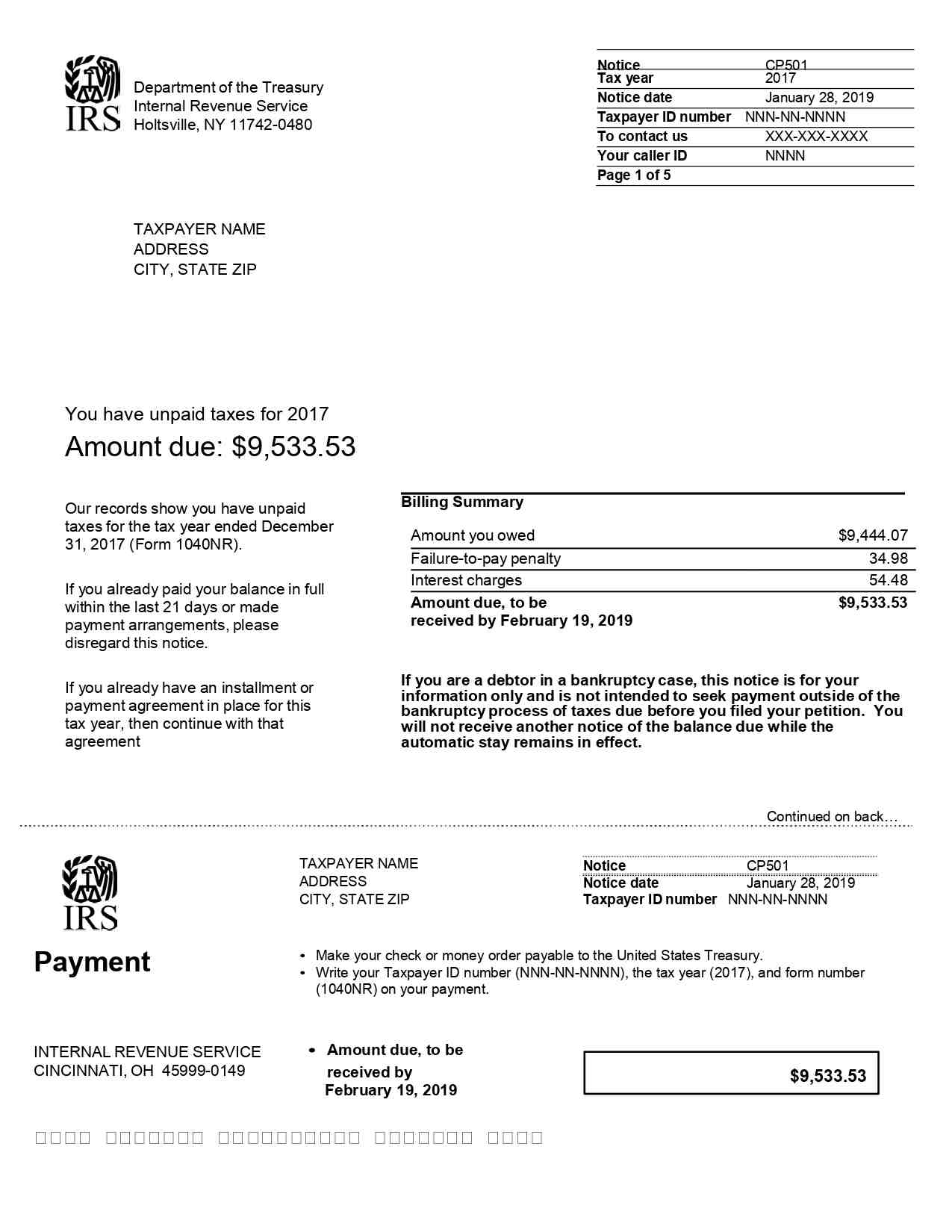

Taxpayers who owe less than $25,000 in taxes may qualify for a Streamlined Installment Agreement. This IRS program is designed to make it easier to pay off any tax debts over time without putting you at financial risk. Read on to see how we helped our client set up an agreement to tackle $22,000 in unpaid taxes.

Situation

John, a single professional residing in Fulton County, Georgia, first came to us for help with unfiled tax returns and an outstanding balance of $12,000 on his tax account. But after we prepared and filed his missing tax returns, we found he owed the IRS an additional $10,000.

Solution

By leveraging his monthly income of $6,000 and $75,000 in home equity, John was able to qualify for a Streamlined Installment Agreement. Negotiating on John’s behalf, we were able to set up a manageable $305/month direct debit payment with the IRS

Result

The entire process, including tax preparation, filing, and agreement setup, took just three months to complete. And since John’s tax debt was below $25,000, he managed to prevent a tax lien from being filed against his home.

Account Diagnosis

- Missing tax returns for 2020-2022

- Open balance of $12,000 from 2018-2019

Program Evaluation

- Based on John’s monthly income and equity, he qualified for a Streamlined Installment Agreement

Submission & Monitoring

- Once we filed John’s missing tax returns, we were able to help him set up a direct debit installment plan with the IRS