Updated in April 2023

Tax Relief via Partial Pay Installment Agreement

Overview

If you don’t qualify for Currently Not Collectible Status and aren’t able to pay your tax debt in full, you may be able to set up a Partial Payment Installment Agreement with the IRS. With this type of installment agreement, you’ll be allowed to make smaller monthly payments based on your financial situation. This is the solution we used to help an independent contractor resolve $38,000 in tax debt.

Situation

Meet Dave, a single father in Wayne County, MI. After 4 years of unfiled tax returns and 2 years of outstanding balances, Dave owed a total of $38,000 to the IRS.

Solution

As a self-employed electrician making $3,800 per month in net income, Dave qualified for a Partial Pay Installment Agreement. We were able to help Dave set up a monthly direct debit payment of $150 from his bank account so she could start paying off his balance. Over time, this hardship-based solution will save Dave thousands in IRS tax debt.

Result

This resolution took 6 months to complete from start-to-finish. Because Dave was self-employed, filing his tax returns required more time to gather extra information.

Account Diagnosis

- Missing tax returns for 2018-2022

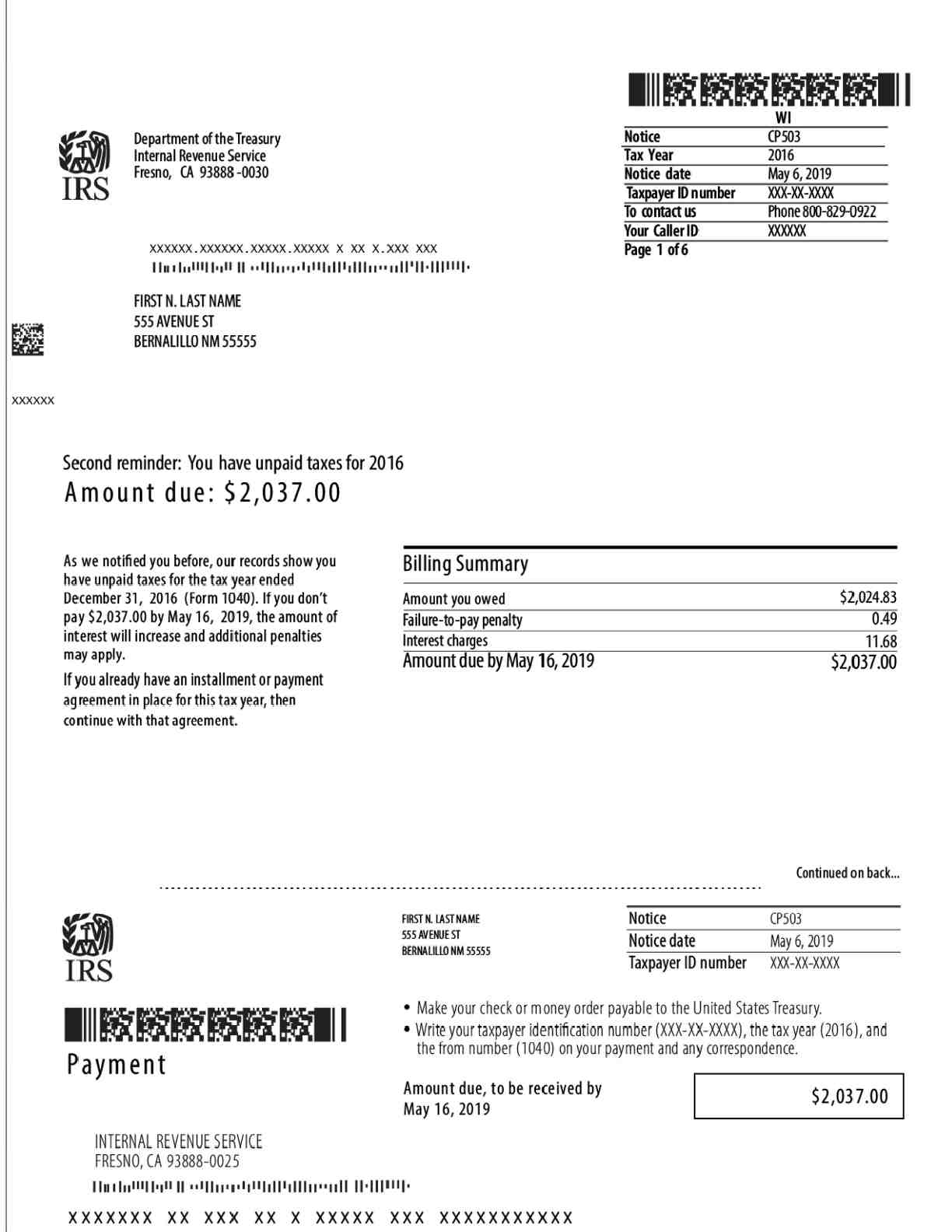

- Open balance of $8,000 from 2016-2017

- Total balance of $38,000 after filing missing returns

Program Evaluation

- Based on the Dave’s monthly income and minimal equity, we determined he qualified for a Partial Pay Installment Agreement

Submission & Monitoring

- Once Dave’s unfiled tax returns had been processed, we were able to set up a direct debit payment plan within 7 weeks